Frequently Asked Questions

Moving from LIBOR to AMERIBOR

Since 2007 regulators have been concerned about discrepancies found in LIBOR and have established a “sunset/elimination” schedule for ending LIBOR in existing and new contracts.

For new loans, USD LIBOR-based agreements will no longer be allowed after December 31, 2021.

All existing LIBOR contracts can continue to reference US LIBOR but will need to convert to a replacement benchmark interest rate after June 30, 2023.

A completely transparent benchmark interest rate index based on overnight unsecured lending on the American Financial Exchange (AFX). The AFX was designed in 2012 and launched in 2015 with over $1 trillion in loan transactions completed since inception.

AMERIBOR reflects the actual overnight and short-term borrowing costs of thousands of small, medium, and regional banks across America.

AMERIBOR Overnight is a transaction volume weighted average interest rate published at the close of each AFX trading session by the Chicago Board Options Exchange “CBOE”.

All of the transacted rates that underly each daily AMERIBOR Overnight are fully visible to the AFX platform members. The AFX currently has approximately 220 members and 1,200 participant banks through its correspondent market, who through the AFX trading system have the ability to continuously monitor and competitively execute rates during a trading session that make AMERIBOR Overnight a competitive benchmark.

Forward-looking term rates out to 30 and 90 days are available through the AMERIBOR Term-30 and AMERIBOR Term-90 benchmarks. In addition to transactions on the AFX, these term rates also incorporate other comparable bank funding transactions.

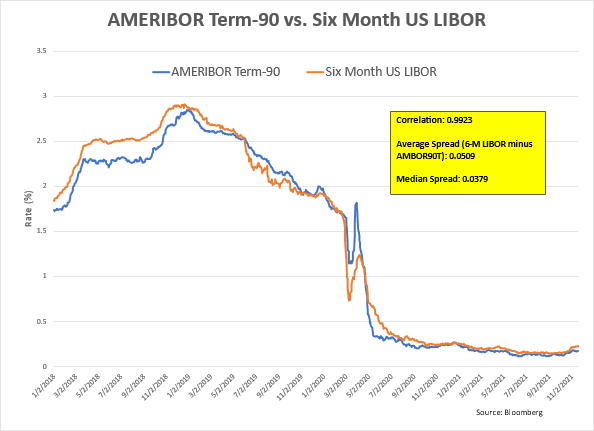

For AMERIBOR Term-90 based loans, rates are expected to mirror the 3-month term US LIBOR and correlate closely with the 6-month term US LIBOR currently referenced in most loans made by Universal Bank.

1. AMERIBOR is a credit-sensitive benchmark rate, similar to US LIBOR.

2. AMERIBOR is based on actual lending transactions (unlike LIBOR which was based on bank quote submissions).

3. AMERIBOR is fully transparent and launched by the American Financial Exchange in 2015. As an exchange member, Universal Bank and all other AFX members have full visibility of and directly contribute to the loan rates that underly AMERIBOR, who in turn collectively make AMERIBOR a market-driven, competitive benchmark rate.

4. AMERIBOR Overnight and AMERIBOR Term-90 are both highly correlated with their comparable US LIBOR rate.

Customers entering into new loans after December 31, 2021, would not have the option to reference LIBOR, including term LIBOR at 1-month, 3-month, 6-month or 12-month reset periods. For example, many Universal Bank loan customers have rates based on 6-month LIBOR.

AMERIBOR term rates are currently available only for 30 or 90-day reset periods, though a 180 day term or longer may become available in the future. Therefore, customers with new loans would need to plan for an interest rate reset period of 90 days.

Customers with existing loans in which the fixed rate term expires between January 1, 2022, and June 30, 2023, can continue to reference 6-month or 12-month LIBOR.

Yes. The U.S. Federal Reserve tasked the Alternative Reference Rate Committee (ARRC) with determining a new reference rate to replace LIBOR. In 2017, the ARRC recommended the Secured Overnight Financing Rate (SOFR). The SOFR overnight and SOFR term rates are risk-free rates, meaning they do not reflect credit risk, and therefore are more suitable for large global banks such as those who contributed quotes to LIBOR and where more derivative instruments are used.

Other credit-sensitive benchmark rates have become available in 2021 such as the Bloomberg Short-Term Bank Yield Index (BSBY). While the BSBY is available in maturities from overnight to one year, the BSBY is based on a complex statistical algorithm that is applied to loan rate data, which can include a mix of actual transacted loan rates as well as quoted rates that are not visible to BSBY users.

All banks must cease using LIBOR as a reference rate for new loans by December 31, 2021, and most financial institutions are undertaking a similar transition currently.

Overnight AMERIBOR: https://ameribor.net/

AMERIBOR Overnight Average Rates for 30-Day and 90-Day compounded in arrears: https://ameribor.net/

AMERIBOR Term-30 and AMERIBOR Term-90: https://ameribor.net/

Futures contracts on AMERIBOR traded on the CBOE: https://www.cboe.com/tradable_products/interest_rate/ameribor_futures/

LIBOR (London Interbank Offered Rate) is the benchmark interest rate banks charge each other for overnight, 1-month, 3-month, 6-month, and 12-month loans. The LIBOR rate is published daily in five currencies: the Swiss franc, the European euro, the British pound sterling, the Japanese yen, and the U.S. dollar, so the migration away from LIBOR will be a global event in the financial markets. In fact, it’s estimated $370 trillion in commercial loans, mortgages, investments, and financial derivatives are tied to LIBOR.

The underlying market that LIBOR is derived from is no longer used in any significant volume.

Accordingly, the ICE Benchmark Administration who administers LIBOR and the U.K.’s Financial Conduct Authority have announced the cessation of LIBOR.

Banks and financial institutions in the U.S. are choosing the replacement to LIBOR that best fits their needs and client base.

As background on why many U.S. banks are choosing AMERIBOR to replace LIBOR, letters signed by numerous mid-size and regional U.S. banks in 2019 and 2020 communicated to U.S. bank regulators their dissatisfaction with SOFR and preference for a LIBOR replacement that was credit-sensitive and matched the banks’ funding costs. They specifically pointed to AMERIBOR as a “credible and robust rate which is easy to explain to customers, regulators and other market participants.”

U.S. bank regulators have issued interagency statements confirming any bank could adopt a replacement benchmark “appropriate to its funding model and customer needs” which would “include using credit-sensitive alternatives to LIBOR.”

U.S. Federal Reserve Chair Jerome Powell has stated in regard to the LIBOR transition that “market participants should seek to transition away from LIBOR in the manner that is most appropriate given their specific circumstances” and that “Ameribor is a reference rate created by the American Financial Exchange based on a cohesive and well-defined market.”

Launched in 2015 as a replacement to LIBOR and designed to represent the funding costs of a diverse base of U.S. banks and financial institutions.

AMERIBOR also adheres to all 19 principles for financial benchmarks established by the International Organization of Securities Commissions (IOSCO), a world-wide benchmark standard-setting body relied on by U.S. bank officials and financial market participants.

The AMERIBOR Term-90 correlates closely with the 6-month LIBOR as the chart below demonstrates.

AMERIBOR and LIBOR are both credit-sensitive borrowing rate benchmarks, meaning they both reflect the risk inherent in unsecured short-term loans. AMERIBOR was designed for and administered in the U.S., while LIBOR is determined in the London banking center.

Unlike LIBOR, which is based on banks’ judgment, AMERIBOR Overnight and AMERIBOR Term-90 are determined from a large volume of actual interbank lending transactions conducted on the AFX trading system or provided to AFX from the Depository Trust & Clearing Corporation for short-term, unsecured loans executed outside of the AFX trading system.

No new LIBOR-based loans or assets will be originated after December 31, 2021. Existing loans and assets will be required to transition away from LIBOR after June 30, 2023. For new loans, Universal Bank will cease referencing US LIBOR in its commercial and real estate loan agreements after December 2021.

At Universal Bank, LIBOR-based loan agreements generally include language that describes the conditions and process for a switch to an alternative benchmark. If such language does not exist, please contact by phone (888) 809 – 8282 or by email at Loanservicedepartment@universalbank.com to discuss an amendment to provide for an alternative benchmark rate.

For loans currently based on LIBOR, including commercial and real estate loans, the move away from LIBOR will take place following June 30, 2023. Once a loan converts, future interest rate accruals will no longer be calculated using LIBOR.

For LIBOR based loans you should determine if there is benchmark replacement language already in place. Your loan agreement may contain a section which describes the replacement benchmark if LIBOR is unavailable. If you find that the replacement language is not adequate, discuss your options by calling (888) 809 – 8282 or by emailing Loanservicedepartment@universalbank.com

Universal Bank will provide you with specific information if your loan is affected. In the meantime, if you have questions about your exposure to LIBOR and the potential impact of the transition to AMERIBOR, please reach out by calling (888) 809 – 8282 or by emailing Loanservicedepartment@universalbank.com